It has certainly been a rough year for homebuilding stocks, but not nearly so bad for the housing market. The Lark Research Homebuilder Stock Price Index, an equal weighted average of eleven publicly-traded homebuilder stocks, was down 29.2% year-to-date through December 7. By comparison, the S&P 500 has declined 1.5% and the Russell 2000 has declined 5.7%.

Homebuilding stocks have been declining for most of the year. The steepest parts of the decline occurred in January, following a tax cut driven surge at the end of 2017 and from mid-September to mid-October, in conjunction with the sell-off in the broader market. Since hitting a November 16 low, however, homebuilding stocks have outperformed the market, rising 3.7%, compared to declines in the S&P 500 and Russell 2000 of 3.8% and 5.2%, respectively.

The January plunge in homebuilding stocks marked the start of the slowdown in the housing market. The chart above suggests that single-family housing starts and permits are beginning to roll over; while the chart below shows that new home sales (on a seasonally-adjusted annual basis) peaked a little over a year ago in October 2017. The slide in new home sales appears to have gained momentum in October 2018 (but the figures are still subject to revision).

The actual (i.e. non-seasonally-adjusted) figures year-to-date for both single-family starts and new home sales show are still showing gains. Single-family starts are still up 5.5% and new home sales are up 2.9% through October, but the percentage gains have weakened steadily throughout the year. More worrisome is the year-over-year drop in actual monthly new home sales of 10.0% in September and 13.9% in October. Although those figures are still subject to revision, it seems likely that both months will still register declines when the final numbers are in. If the most recent downward trend continues, single-family starts and sales will likely post 2018 full year results that will be at best even with 2017 totals.

The recent sharp drop in new home sales has finally begun to weigh on homebuilder sentiment. The NAHB/Wells Fargo Housing Market Index dropped sharply in November from 68 to 60. (50 is the neutral level.) That was the steepest drop since January 2014. All three components of the index – the current sales pace, current buyer traffic and sales expectations six months out – posted sharp declines. Up until October, the HMI had been hovering between 67 and 70 for most of the year.

The drop in November’s HMI is consistent with the market commentary provided by Toll Brothers in its recent fiscal 2018 fourth quarter earnings release and conference call. Toll reported a 13% decline in its fiscal fourth quarter unit orders (against exceptionally strong prior year orders). CEO Doug Yearley said orders softened further in November, which he attributed to rising mortgage rates and effect on buyer sentiment of media reports about the housing slowdown. Mr. Yearley said that the company experienced a similar buyer behavior in late 2013, when a sharp rise in mortgage rates temporarily tempered buyer demand.

Most of the builders have similar views of the causes and likely consequences of the 2018 housing market slowdown. They attribute it to the combination of rising mortgage rates and rising house prices, which have crimped affordability. Despite the slowdown, they see the pace of current activity as still strong. With expectations that the economy will likely remain strong, with solid but perhaps moderating employment growth, rising wages and high consumer confidence, they expect that orders will begin to rebound once buyers adjust to the higher mortgage rates.

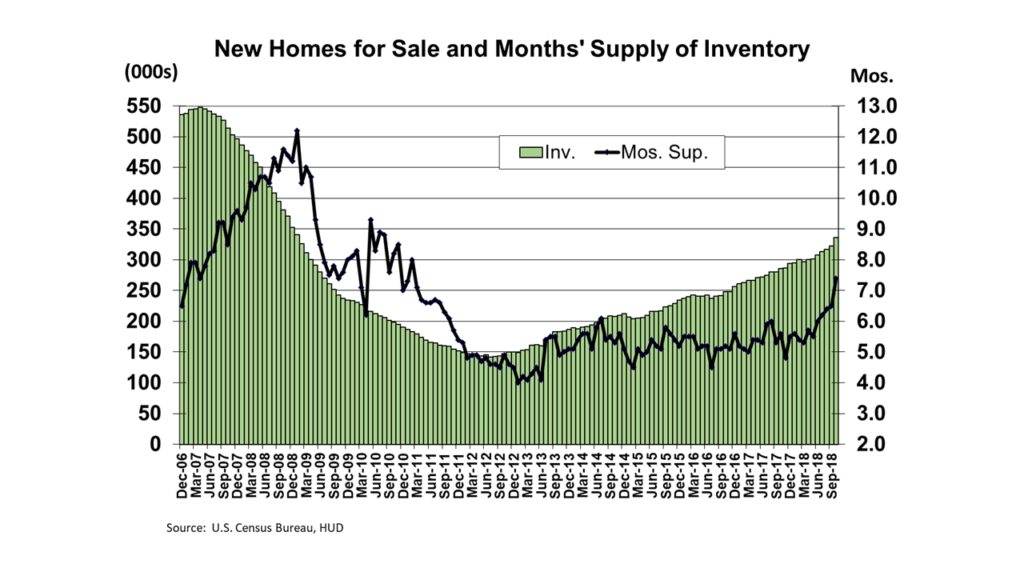

Despite the softening, the underpinnings of the housing market still seem solid. Housing production is still only half the 2006 peak level. Consumer debt burdens are lower. Mortgage defaults are near record lows. Mortgage underwriting standards remain tight. Although the supply of new home inventories has climbed sharply over the past few months to 7.4 months, that is still well below the 2009 peak of 12.2 months.

The decline in new home sales is also reflected in the year-over-change in homebuilder unit orders, which is shown in the table below. After a surge in the 2017 fourth quarter (that coincided with the spike in homebuilder share prices), the average rate of growth in new orders has slowed with each successive quarter.

Given the recent increases in mortgage rates and a likely rate hike by the FOMC at its December meeting (12/18-12/19), net new orders for the 2018 fourth quarter will probably decline.

The housing market should be able to adjust to the new higher level of mortgage rates, but the process of adjustment will probably not conclude until sometime after the Federal Reserve stops raising the benchmark Fed Funds rate. In a recent speech, FedChairman Powell said that the current level of interest rates was near the so-called neutral level of interest rates (which is the rate that would neither stimulate nor suppress economic activity).

Since that speech, the financial markets seem to have built in expectations of “one and done,” – that the FOMC will raise the Fed Funds rate in December and then pause (or perhaps even stop). If that happens, the combination of recent gains in household income (due to growth in employment and wages) and a still quite reasonable average rate of 5.00% for 30-year fixed-rate mortgages could support an eventual rebound in sales.

With the share price declines, homebuilder stock price valuations have fallen sharply. The average homebuilder’s stock is now trading at only 10 times trailing earnings and less than eight times forward earnings (for 2019). By comparison, the S&P 500 is trading at 17.5 times trailing operating earnings and 15.1 times forward operating earnings.

Although the disparity in forward multiples almost certainly reflects different perceptions about long-term earnings growth prospects, it is also fair to say that the exceptionally low forward multiple now assigned to homebuilding stocks suggests considerable skepticism about homebuilder forward estimates. In fact, those forward multiples for homebuilding stocks imply that the industry is heading into a downturn that will produce double-digit declines in earnings. (The difference in forward multiples represents a discount of about 50%.) So while forward estimates for the builders will likely come down, it would be quite surprising if they come down to a level that justifies current (or lower) stock prices.

Given the stronger relative performance of homebuilding stocks over the past couple of weeks and the likelihood that the Fed will soon pause in its campaign to normalize interest rates, a case can be made for tiptoeing back in to the sector. However, the recent sharp decline in new home sales and the HMI combined with the steep slowdown in order growth suggests that it may be a couple of quarters (or more) until the sales pace bottoms and begins to turn up again. The market may cheer if the Fed pauses at its December meeting, but it may blow raspberries later if the slide in housing activity continues at a steep pace over the next quarter or two. Ideally, there should be a successful retest of the mid-November low sometime within the next month or two to confirm that a bottom has been put in. In recent years the market has often not provided such reassurances, but I believe that it is prudent in this case to wait for such confirmation before jumping completely back in.

December 9, 2018

Stephen P. Percoco

Lark Research

839 Dewitt Street

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2015-2025 by Stephen P. Percoco, Lark Research. All rights reserved.

This blog post (as with all posts on this website) represents the opinion of Lark Research based upon its own independent research and supporting information obtained from various sources. Although Lark Research believes these sources to be reliable, it has not independently confirmed their accuracy. Consequently, this blog post may contain errors and omissions. Furthermore, this blog post is a summary of a recent report published on this subject and that report provides a more complete discussion and assessment of the risks and opportunities of any investment securities discussed herein. No representation or warranty is expressed or implied by the publication of this blog post. This blog post is for informational purposes only and shall not be construed as investment advice that meets the specific needs of any investor. Investors should, in consultation with their financial advisers, determine the suitability of the post’s recommendations, if any, to their own specific circumstances. Lark Research is not registered as an investment adviser with the Securities and Exchange Commission, pursuant to exemptions provided in the Investment Company Act of 1940. This blog post remains the property of Lark Research and may not be reproduced, copied or similarly disseminated, in whole or in part, without its prior written consent.

By Housing Market Update – February 2019 | Lark Research February 20, 2019 - 2:46 PM

[…] weeks, reversing the sharp downtrend that was evident for virtually all of 2018. (As noted in my previous housing update, that rebound in homebuilding stocks preceded the rebound in the broader […]