Treasurys Outperform TIPS in 23Q4 Amid Easing Inflation

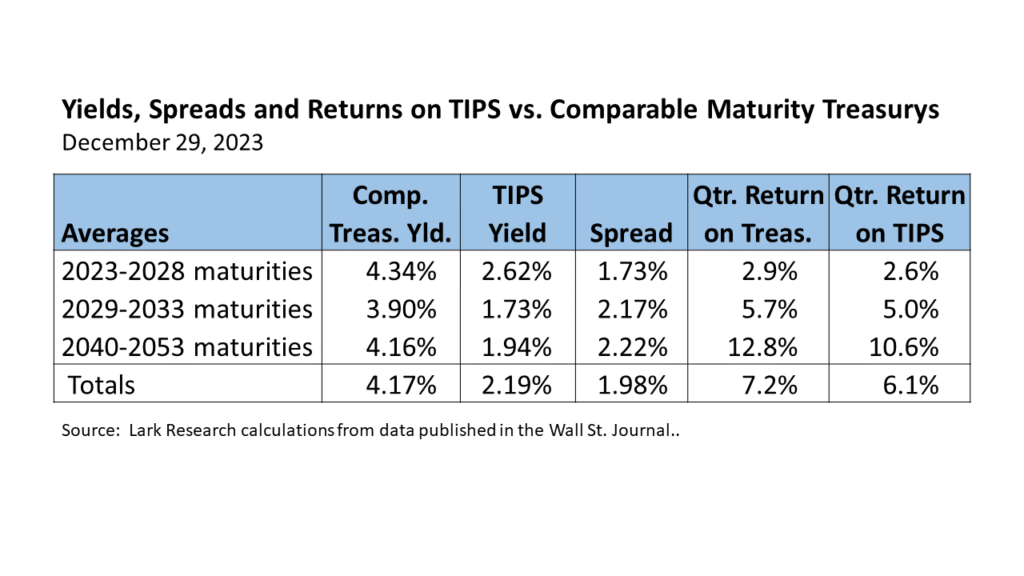

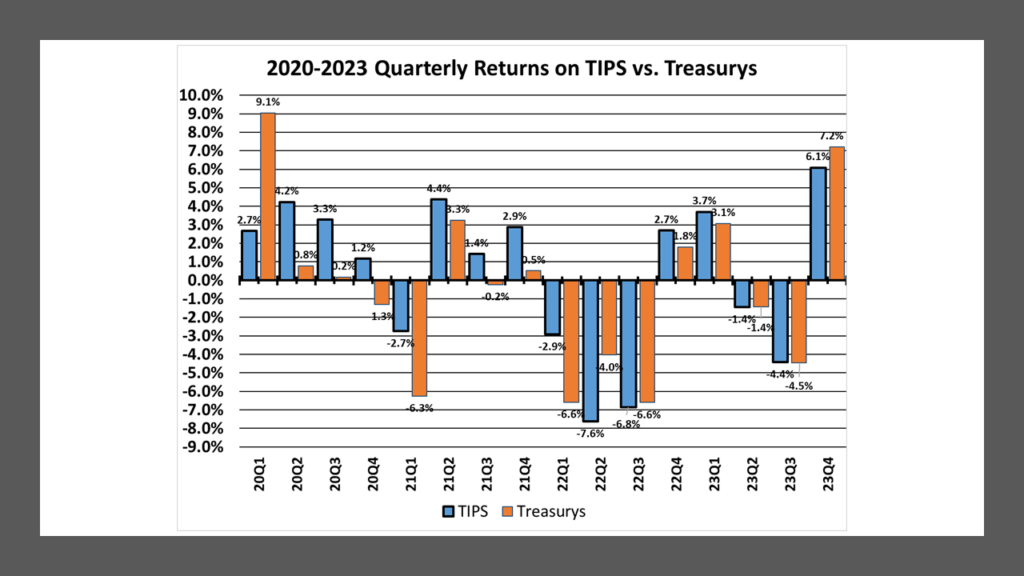

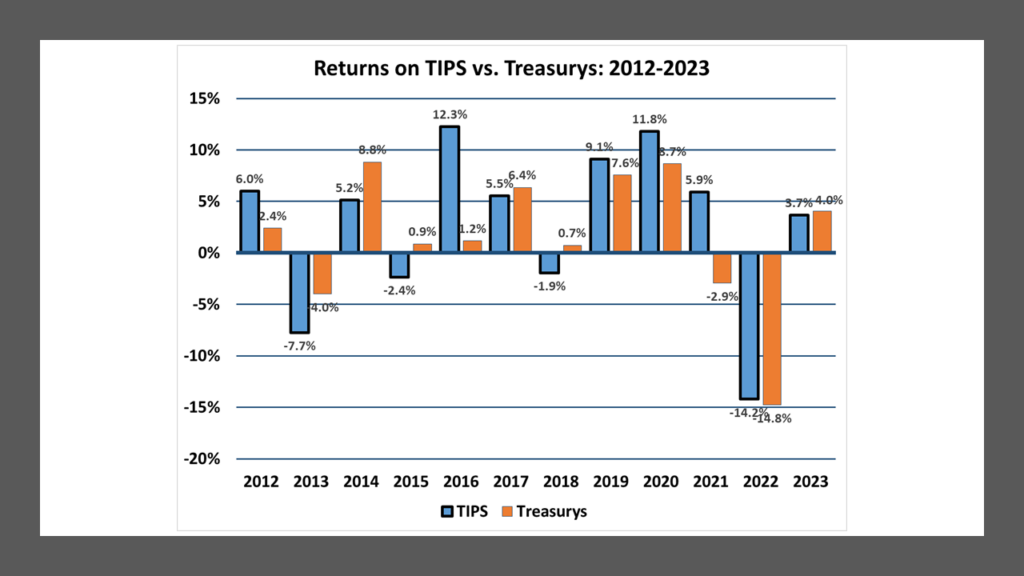

Treasury Inflation-Protected Securities (TIPS) posted an average gain of 6.1% in the 2023 fourth quarter, modestly below the 7.2% average gain on comparable maturity straight Treasury securities. The return on TIPS was composed roughly of an estimated average price gain of 440 basis points (bp), estimated interest income of 85 bp and an inflation adjustment was 65 bp.

TIPS underperformed Treasurys across all maturities. In the short maturities, TIPS and comparable maturity straight Treasurys posted returns of 2.6% and 2.9%, respectively. In the intermediates, Treasurys outperformed TIPS by 70 bp, with estimated returns of 5.0% for TIPS and 5.7% for Treasurys. In the long-term maturities, TIPS gained 10.6% and Treasurys 12.8%, according to my estimates.

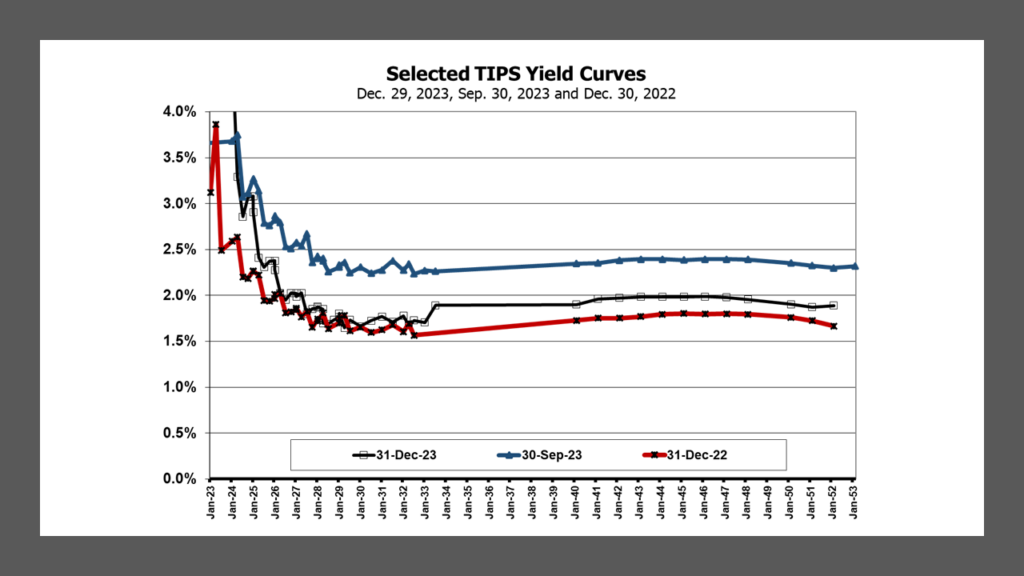

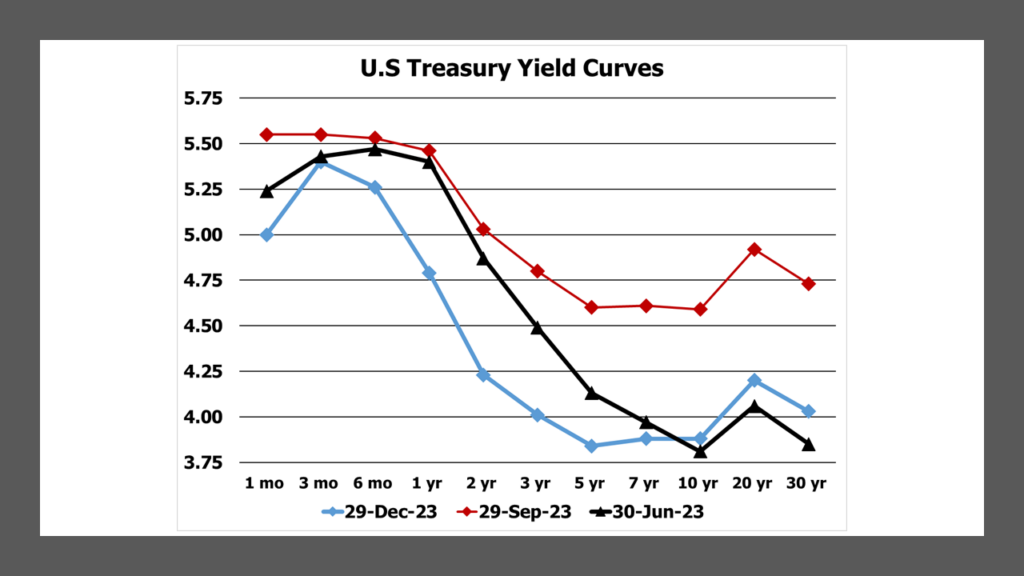

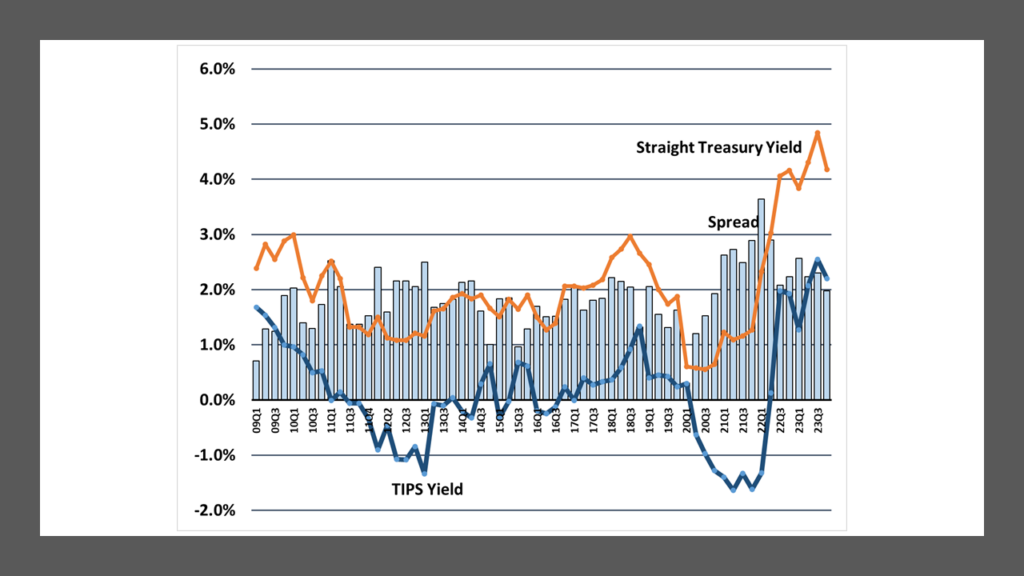

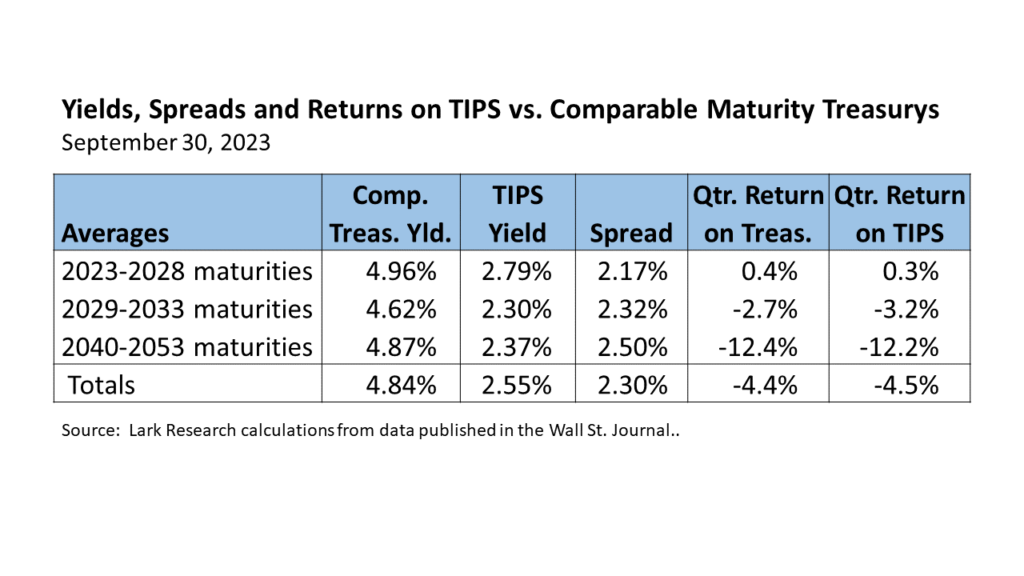

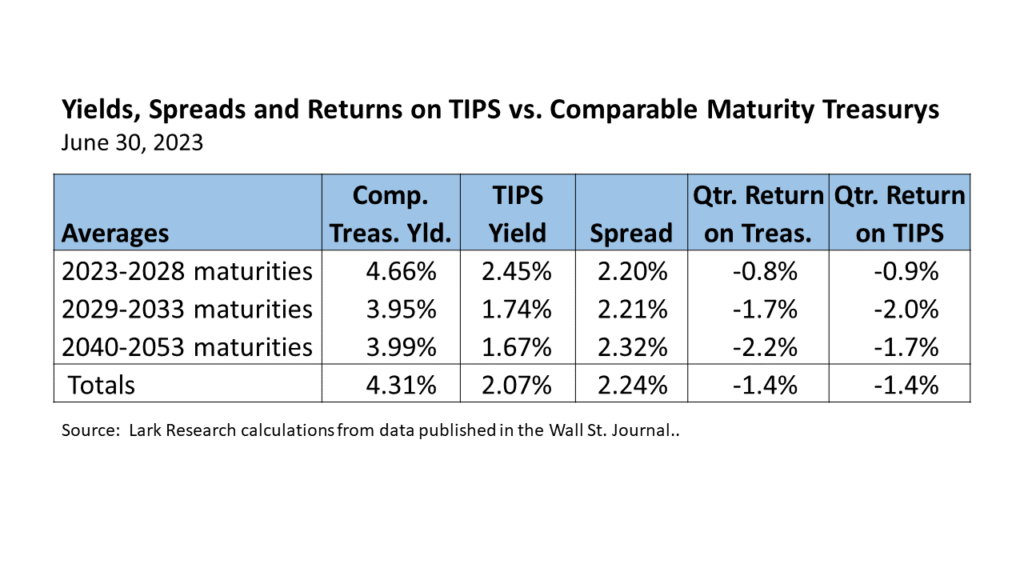

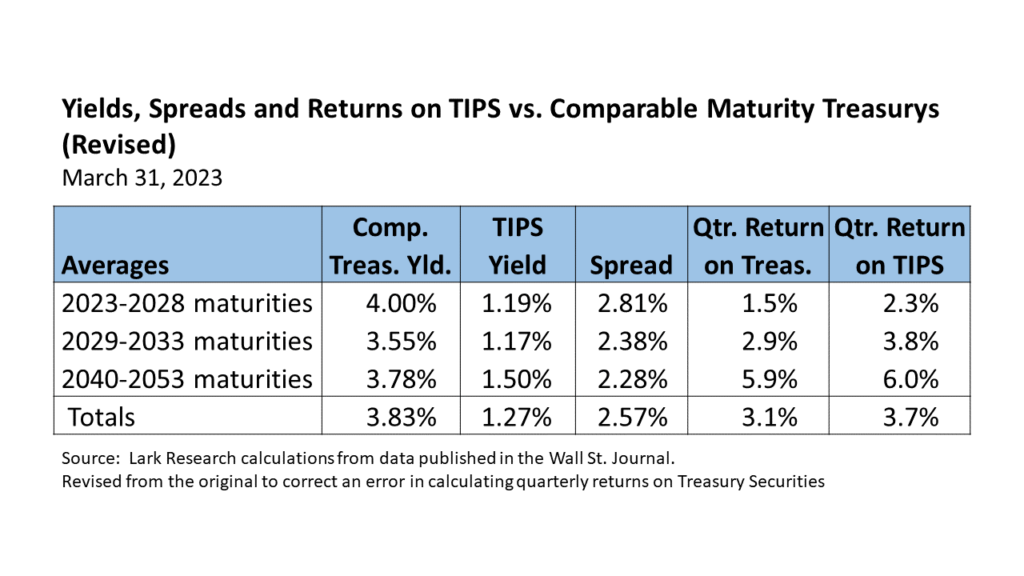

The average TIPS yield ended the quarter at 2.19%, down 36 basis points (bp) from 2.55% at the end of the 2023 third quarter. Average straight Treasury yields ended the quarter at 4.17%, down 67 bp from 4.84% in 23Q3. The greater decrease Treasury yields reduced the breakeven spread by about 32 bp to 198 bp at December 29 from 230 bp at September 29.

The decline in TIPS yields and reduction in the breakeven spread were consistent with the further easing of inflation. The increases in both the Consumer Price Index and the Personal Consumption Expenditures deflator, which is the Federal Reserves preferred measure of inflation, slowed markedly in October and November. (December’s inflation data will be reported later this month.) Most of the easing in headline inflation is attributable to the decline in energy prices, but core inflation has been falling too due mostly to the easing of supply chain pressures.

TIPS yields declined across the intermediate and long maturities but shifted higher across short maturities, as investors demanded a higher yield to compensate for the decline in inflation.

As noted, straight Treasury yields fell by 67 bp during the quarter, while TIPS yields eased by 36 bp. The declines in yields for both TIPS and Treasurys produced gains across all maturities, with double-digit gains across the long-term maturities.

Treasury yields fell about 75 bp on average across 1-year to 30-year maturities.

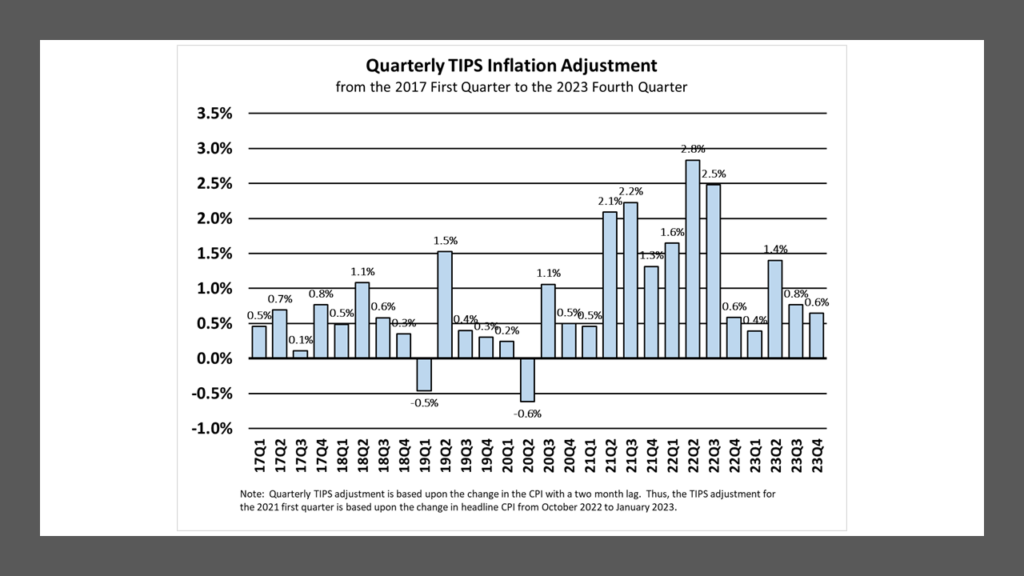

The quarterly TIPS CPI inflation adjustment slipped from 77 bp in 23Q3 to 65 bp in 23Q4. I had expected an increase in the adjustment due to the pick-up in headline inflation for August. However, September’s headline CPI increase was modest and October’s actually declined, leading to a smaller increase in the inflation adjustment than expected for the fourth quarter. With another decline in headline CPI in November and a further easing in energy prices in December, it seems likely that the inflation adjustment will be even lower in 24Q1.

The easing of CPI inflation is mirrored in the PCE deflator. With recent revisions going back to July, the annualized 3-month change in headline PCE inflation had increased steadily from 1.83% in July to 3.67% in October, but it eased to 2.63% in November. Even so, the PCE inflation has slowed markedly from around the 4% levels posted earlier in 2023.

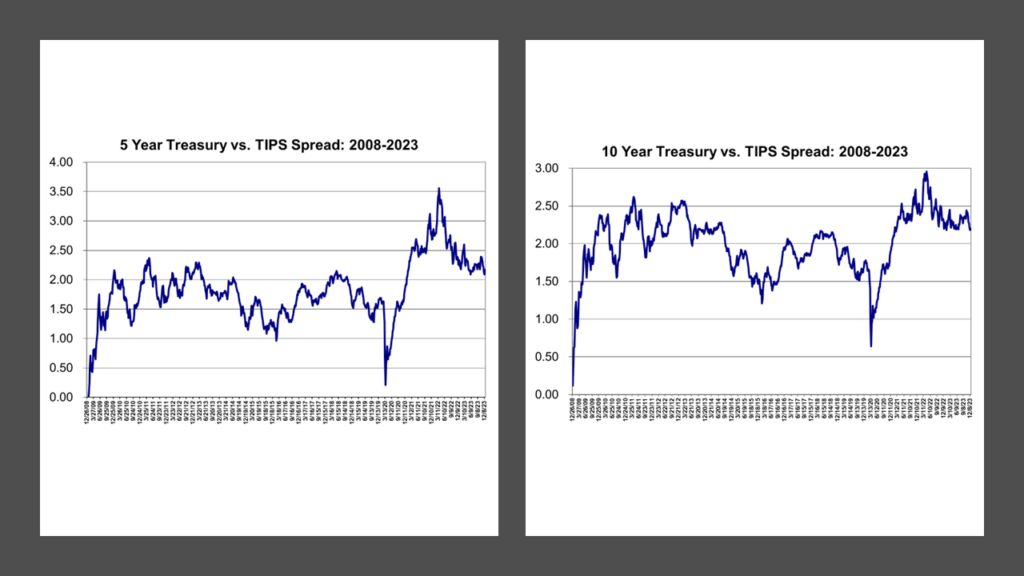

Although TIPS and Treasury yields remain elevated (compared with average levels over the past fifteen years), the breakeven spread at just under 200 bp is only slightly above the historical average. Spreads have declined in 2023 from the elevated levels seen from 2020 to 2022.

At this point, it is difficult to predict where yields, spreads and returns are headed. The 23Q4 rally across all fixed sectors has been steep, raising the likelihood of a near-term correction. Inflation has moderated closer to Fed target levels, but if rate cuts do occur in the second half of 2024 as the financial markets now expect, it seems likely that yields will fall mostly across the shorter maturities, which will produce only modest gains. It also seems likely that longer-term yields will not fall much more from curent levels unless there is a marked slowdown in the economy (beyond what the financial markets currently expect). All things equal, any meaningful decline in long-term rates from here will also likely weigh on the dollar, which could cause inflation to rise. In a stagflation scenario, TIPS would most likely outperform straight Treasurys.

Published and posted on January 2, 2024

Stephen P. Percoco

Lark Research

839 Dewitt Street

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2015-2025 by Stephen P. Percoco, Lark Research. All rights reserved.

This blog post (as with all posts on this website) represents the opinion of Lark Research based upon its own independent research and supporting information obtained from various sources. Although Lark Research believes these sources to be reliable, it has not independently confirmed their accuracy. Consequently, this blog post may contain errors and omissions. Furthermore, this blog post is a summary of a recent report published on this subject and that report provides a more complete discussion and assessment of the risks and opportunities of any investment securities discussed herein. No representation or warranty is expressed or implied by the publication of this blog post. This blog post is for informational purposes only and shall not be construed as investment advice that meets the specific needs of any investor. Investors should, in consultation with their financial advisers, determine the suitability of the post’s recommendations, if any, to their own specific circumstances. Lark Research is not registered as an investment adviser with the Securities and Exchange Commission, pursuant to exemptions provided in the Investment Company Act of 1940. This blog post remains the property of Lark Research and may not be reproduced, copied or similarly disseminated, in whole or in part, without its prior written consent.