Imperial Oil (IMO), in which Exxon Mobil Corp. has a 69.6% stake, is the largest integrated oil company in Canada. Across the value chain, it is a leading producer of oil (primarily through its assets in the Athabasca oil sands), the largest refiner of crude oil, a leading marketer of petroleum products and a major producer of petrochemicals.

Imperial’s ownership position in the Athabasca oil sands is by far its most valuable asset (although not by current reserve valuation methodologies). The company owns or participates in three major oil sands projects:

Cold Lake has been in operation since the 1960s. At Cold Lake, Imperial extracts the bitumen, a sticky form of oil, using conventional “in situ” drilling methods. Over the years, the company has improved its operations, increasing recovery from 20% to 50% of the total resource and now recycling 95% of the fresh water used in the production process.

In 2016, IMO produced 161,000 gross and 138,000 net barrels of bitumen per day at Cold Lake. (Although it owns 100% of Cold Lake, it pays a royalty of roughly 15% to the Alberta government, which explains the difference between gross and net production.) At its Investor Day in September 2016, management reported that Cold Lake’s “2P” reserves (i.e. proven and probable) were 1.7 billion barrels. At the 2016 production rates, IMO had 30 years of reserves at Cold Lake.

IMO owns a 25% stake in Syncrude, a joint venture with Suncor Energy (53.7%), Sinopec (9.0%), Nexen (7.2%) and Mocal (5%). Sale of Syncrude’s synthetic light sweet oil is subject to a royalty to the government of Alberta (which adjusts with the price of oil). In 2016, IMO’s share of Syncrude’s production was 67,000 net barrels per day (on 68,000 gross barrels). Thus, Syncrude’s total gross production was about 268,000 b/d or 76.6% of its nameplate capacity of 350,000 b/d. In September 2016, IMO estimated its share of Syncrude’s 2P reserves at 1.1 billion barrels, giving it a reserve life of about 44 years at 2016 production levels.

Kearl is another joint venture, 71%-owned by IMO and 29% by ExxonMobil Canada Properties. The project utilizes open-pit mining to extract the bitumen and then mixes the bitumen with diluent (i.e. natural gas condensate), removing the heavy asphaltenes to facilitate its transport by pipeline or rail to IMO and Exxon refineries. This paraffinic technology eliminated a $20 billion investment in an upgrader, which converts the bitumen to synthetic crude oil on site.

Kearl is another world-class asset for IMO, originally conceived in three stages, two of which have been completed. The company’s share of gross production has increased steadily from 51,000 barrels per day in 2014 to 120,000 barrels per day in 2016. Including Exxon’s 29% share, total production at Kearl is estimated to have increased from 72,000 b/d in 2014 to 169,000 b/d in 2016. 2016 production was affected in May and June by the fires at Fort McMurray. Kearl has a regulatory limit of 350,000 barrels on a stream-day basis. It continues to de-bottleneck operations and improve operating efficiency to maximize its output.

In September 2016, IMO reported estimated 2P reserves of 3.2 billion barrels at Kearl. Total 2016 gross production was 169,000 barrels per day (IMO’s share: 120,000 b/d). IMO is targeting production of 220,000 barrels per day, which would give the 2P reserves a life of 40 years.

As a result of low oil prices early in 2016, IMO was required to remove all of Kearl’s 2.5 billion barrels from its proved reserve estimates. At year-end, the company reported total proved reserves (developed and undeveloped) of bitumen and synthetic oil of 1.26 billion barrels, down from an estimated 4.10 billion barrels at the end of 2015. Imperial says that the write-off of reserves will not affect production at Kearl at current oil price levels.

Besides these three large oil sands projects, Imperial owns conventional and unconventional (i.e. shale) assets in the McKenzie Delta and Beaumont Sea in northern Canada and in the Duvernay and Montney formations in Alberta province. It also owns 80,000 net acres of undeveloped, mineable oil sands acreage in the Athabasca region and has interests in 193,000 undeveloped acres that are suitable for in-situ recovery methods. Included in the 193,000 acres is the Aspen project, covering 34,000 net acres, which is currently in the planning stages.

As with all oil & gas producers, IMO’s Upstream business has suffered over the past couple of years. Operating revenues fell from C$27.8 billion in 2014 to C$21.8 billion in 2016 and net income plunged from C$2.1 billion to a loss of C$0.7 billion. So far this year, Upstream’s operating revenues have rebounded from C$2.4 billion to C$3.5 billion and its net loss has narrowed from $0.7 billion to $0.3 billion. Higher price realizations were partially offset by higher royalties, higher energy costs and lower profitability at Syncrude, whose upgrader went out of service in March due to a fire.

Besides the Upstream, Imperial is a leader in the Downstream. Its Downstream businesses include Supply, Transportation, Refining, Distribution and Marketing.

- Supply purchases (from Upstream and others) crude oil, condensate and petroleum products for its Refining and Marketing operations.

- Transportation supplies refineries (IMO’s and others) with crude oil shipped by pipeline, common carrier and rail (including on IMO’s own rail infrastructure completed in 2015).

- In Refining, IMO owns three refineries that process primarily Canadian crude oil. The refineries have a combined rated capacity of 423,000 barrels per day and operated at capacity factors of 85.6% in 2016 and 89.4% in the first half of 2017.

- In Distribution, IMO has a nationwide system of pipelines, trucks, tankers and rail that moves bulk and packaged petroleum products from refineries to market. The company owns natural gas and NGL pipelines as well as equity interests in a few pipeline companies.

- In Marketing, IMO sells its petroleum products through a network of 1,700 independently owned and operated Esso and Mobil-branded gas stations. (It sold all of its company-owned gas stations in 2016.) It also sells petroleum products to industrial companies, transportation firms, independent marketers, resellers and other refineries.

Product sales in the Downstream have averaged just under 500,000 barrels per day equivalent over the past three years. Yet, operating revenues declined sharply from C$26.4 billion in 2014 to C$18.5 billion in 2015. Segment earnings, excluding a C$1.8 billion gain in 2016 on the sale of gasoline stations and an aviation servicing business, declined from C$1.6 billion in 2014 to C$0.9 billion in 2016.

In the 2017 first half, Downstream revenues improved to C$9.9 billion from C$8.5 billion in the prior year; but segment earnings, excluding a C$151 gain from the sale of surplus property in the current year, declined again from C$391 million to C$307 million. Part of the decline was due to the sale of the company-owned gas stations in 2016, but marketing margins remain under pressure across the industry.

IMO’s Chemicals operations are adjacent to its Sarnia refinery in southwestern Ontario. The Chemicals segment produces and sells benzene, aromatic and aliphatic (non-aromatic) solvents, plasticizer intermediates and polyethylene resin. As with the Upstream and Downstream businesses, operating revenues and profits have declined since 2014. Operating revenues were C$1.05 billion in 2016, down 12.4% on a 3.4% decline in sales volume (to 908,000 tonnes) and net income declined 35% to C$187 million, mostly due to weaker margins. So far in 2017, revenues increased 8.7% to C$562 million, while net income rose 4.8% to C$109 million.

Although Imperial, like all integrated oil & gas companies, has struggled to maintain its profitability, it recent cash flow performance has improved significantly, due mostly to the winding down of capital expenditures on the Pearl project.

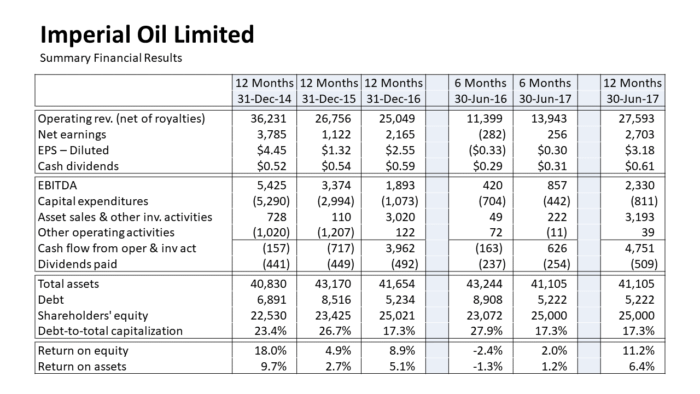

From 2014 to 2016, IMO’s EBITDA fell by more than half from C$5.4 billion in 2014 to C$1.9 billion in 2016. Over this same time period, however, capital expenditures dropped from C$5.3 billion to C$1.1 billion, primarily due to the completion of the first two phases of the Kearl project. As a result, IMO’s free cash flow, which I define as net cash flow from operating and investing activities, was positive in 2016, despite the sharp drop in profits.

A longer-term review of IMO’s financial performance shows that its capital expenditures ramped up steadily from about C$900 million in 2007 to a peak of C$6.3 billion in 2013, primarily due to Kearl. Also in 2013, IMO paid C$1.6 billion for a 50% interest in XTO Canada, which is involved in conventional (and unconventional) exploration and development activities for natural gas, oil, condensate and natural gas liquids.

AAA-rated Imperial saw its debt increase from C$140 million in 2008 to a peak of C$8.5 billion in 2015. Its ratio of debt-to-total capitalization rose from 1.6% to 26.7% over that same time frame. In 2016, IMO used the C$3 billion of proceeds from asset sales, primarily the sale of its company-owned gas stations, to reduce debt. It ended the year with C$5.2 billion in debt and a debt to cap ratio of 17.3%.

Imperial has a number of projects on the drawing board, including expansions at Kearl and Cold Lake, a new in-situ oil sands project at Aspen, exploration and development of its holdings in the Duvernay and Montney formations and the eventual development of its positions in the McKenzie Delta and Beaufort Sea. Even so, its capital spending is not likely to approach 2013 levels again for quite some time, if ever.

So far in 2017 (through June 30), IMO has returned to profitability, reversing last year’s net loss of C$282 million to a gain of C$256 million. Free cash flow has also improved from negative C$163 million to positive C$706 million. The better performance was due mostly to significantly improved price realizations for bitumen and synthetic crude, up 80% and 38% over prior year levels. However, year-over-year comparisons will be less favorable in the second half. Still, my projections suggest that IMO’s cash flow from operating activities should come in at about C$2.7 billion in 2017 and its free cash flow (excluding the effect of asset sales) should improve to C$1.2 billion in 2017 from C$941 million in 2016.

In its 2016 Investor Day presentation, IMO indicated that its capital spending should average C$1.5 billion annually going forward, with C$900 million of maintenance and C$600 million of growth expenditures. Annual dividend payments currently total C$540 million. Thus, the combination of maintenance capex and dividend payments equals C$1.44 billion annually, which is well below 2016’s cash flow from operating activities of C$2.0 billion. Since 2016 should turn out to be the trough year of the cycle, the company should have at least $600 million in annual free cash flow going forward that it could return to shareholders.

Despite the surplus cash flow, IMO should continue to be prudent in managing its financial position. While its ongoing required investment in the oil sands is low, its operating costs are higher than conventional oil & gas assets. Thus, low oil prices have a disproportionately negative impact on both its profitability and on the value of its reserves compared to typical upstream producer.

Because WTIC crude prices averaged less than $40 per barrel in the 2016 first half, IMO was forced declare all of Kearl’s 2.5 billion barrels of crude proved reserves and 200 million barrels of its Cold Lake proved reserve to be uneconomic. As a result, IMO’s total proved reserves declined from 4.2 billion barrels in 2015 to 1.4 billion barrels in 2016. Interestingly, the estimated net present value of those reserves under certain simplifying assumptions, including a 10% discount rate (its “PV-10”), declined only modestly from C$3.23 billion to C$2.75 billion, despite the sharp reduction in proved reserves.

The big damage to IMO’s PV-10 was done in 2015, when it plunged to C$3.23 billion from C$31.1 billion, almost entirely because of an estimated 46% drop in estimated average selling prices. Consequently, IMO’s PV-10 is not likely to return to the C$30 billion level until price realizations nearly double from current levels. By comparison, IMO’s current equity market capitalization is just under C$31 billion, but that also reflects the value of its Downstream and Chemical businesses. Although IMO’s PV-10 value probably will not improve much in 2017, it is likely that the reserves at Kearl and Cold Lake will be added back to total proved reserves, as along as oil prices remain at or near current levels.

Despite its higher cost oil sands operations, IMO should continue to generate free cash flow as long as oil prices do not fall below the mid-$40s on a sustained basis. For that reason, I believe that the company can afford to pay a higher dividend.

IMO’s current annual dividend of C$0.64 per share represents a yield of 1.8% at the current share price of C$36.53. By comparison, its parent, Exxon Mobil, pays a dividend of $3.08 per share, equal to a 4.0% yield at the current price of $76.76. Although it is probably true that Exxon’s other oil & gas assets, excluding IMO, have an average operating cost below IMO’s, they are not generating nearly as much free cash flow to support XOM’s dividend. This is illustrated in the table below:

The table shows that, excluding IMO, Exxon’s other businesses generated $6.5 billion in cash flow from operating and investing activities, enough to cover about half of the common stock dividend payment of $12.5 billion. Although Exxon has remained committed to supporting its own dividend, despite the cash flow deficit, it is surprising that it continues to offer only a 1.8% payout to IMO shareholders. Having completed most of the Kearl project, IMO is in a better position to generate free cash flow for the foreseeable future. This suggests that shareholders should receive a dividend that is much closer in yield to Exxon’s, if not higher. Of course, Exxon could achieve parity in the payout simply by cutting its own dividend. Indeed it may very well be forced to do so, if its upstream business does not begin to show meaningful progress with the next couple of years.

Exxon is not ignoring the disparity. It has raised IMO’s dividend by 13.5% over the past couple of years, more than the 10.4% increase in its own common stock. IMO also initiated a share buyback program in June, under which it may purchase up to 3% or 25.4 million of its outstanding shares. At the current price, that represents a total expenditure of $927 million. Under the program, Exxon has pledged to retain its current equity stake of 69.6%, so the buybacks will be done in proportions equivalent to the ownership stakes. Even with the buyback program, I think that IMO shareholders should still press for yield parity with Exxon shareholders.

The quest for yield parity is also justified given the relative performance of IMO and XOM shares. Since the March 2009 stock market bottom, IMO has delivered a total average annual return of just 0.1%, while XOM has delivered 5.3% and the S&P 500 16.3%. By my rough estimates, about 40% of the difference between IMO’s and XOM’s shareholder returns is due to the difference in dividend yields.

IMO and XOM almost reached parity in post-financial crisis total returns in July 2014, at the peak of the oil market, but since then, IMO’s stock has suffered a more significant slide, probably due to its higher marginal operating costs vis-à-vis conventional producers. Still, the market seems to be ignoring IMO’s strong financial position and improving financial performance over the past few years.

The cost of giving IMO’s external shareholders dividend parity is not overwhelming. A 4% dividend yield would require IMO to raise the annual dividend from C$0.64 currently to C$1.45. In total, that would increase the annual payout by C$684 million to $C1.22 billion. 69.6% of that increase or C$476 million would go to Exxon. The cost of giving external shareholders a 4% dividend would therefore be C$208 million annually. Exxon could consider restructuring IMO’s equity to create two classes of common shareholders, if it did not want to take the extra dividend or did not feel that IMO could cover the higher payment on all outstanding common stock. Alternatively, it could lend the extra dividend payment back to IMO or use it to gain a higher direct ownership stake in future joint ventures with IMO.

Despite its poor relative performance, IMO is well positioned to generate free cash flow, especially in a rising commodity price environment. Its strong financial position and superior cash generating profile suggest that a higher dividend payout is quite feasible. Long-term shareholders have waited a long time for IMO to perform. Giving them a higher dividend is one way to raise the potential floor on their future returns.

August 25, 2017

Stephen P. Percoco

Lark Research, Inc.

839 Dewitt Street

Linden, New Jersey 07036

(908) 448-2246

incomebuilder@larkresearch.com

© Lark Research, Inc. All rights reserved. Reproduction without permission is prohibited.