Based upon management’s guidance given at General Electric’s 2020 Outlook meeting on March 4th, I project 2020 Industrial Leverage EBITDA of $11.6 billion, up roughly 3% from 2019. Industrial Leverage EBITDA was given in the appendix to the company’s 2020 Outlook presentation slides and was meant to be used in the calculation of GE Industrial’s ratio of EBITDA-to-net debt. The measure excludes non-operating pension benefit costs, which is the part of total pension costs that cover all items that relate primarily to the funding of GE’s pension plans, excluding the service cost.

My projections assume a 10% improvement in Power’s EBITDA, reflecting low single-digit growth in revenues combined with a modest expansion in its profit margin. Renewable Energy’s EBITDA improves to breakeven. Aviation’s EBITDA rises up modestly, which reflects management’s expectations that segment profit will be up. Healthcare’s EBITDA declines nearly 19% primarily because of the sale of BioPharma, offset partially by 9% EBITDA growth in the remaining business. I assume that corporate items and eliminations, which exclude goodwill impairment charges and gains (losses) on disposals and held-for-sale businesses, should decline by roughly $500 million, based upon management’s specific guidance for adjusted corporate operating costs and its claim that restructuring costs will be lower. I am also guessing that other items minus dispositions, which are defined as part of Industrial Leverage EBITDA, will decline by a net $100 million in 2020.

My projections are consistent with management’s guidance for 2020 adjusted EPS of $0.50-$0.60, as shown in the table below:

To get to GE earnings from continuing operations before tax of $6.0 billion, I deduct from projected 2020 GE Industrial leverage EBITDA, a $570 million net loss for GE Capital, which is consistent with management’s guidance, $3.3 billion in depreciation and amortization (which is lower by an estimated $200 million vs. 2019 because of the sale of BioPharma) and $1.7 million of interest and other financial charges (which should be down by about $400 million due to the application of most of the BioPharma sale proceeds to reduce debt). After income taxes and preferred dividends, my projected 2020 adjusted net income is $4.4 billion which works out roughly to $0.50 per share.

My analysis, even before the onslaught of COVID-19, suggests that it would be tough for GE to deliver adjusted EPS at the high end of its guidance range. In order to get to $0.60 per share, GE would have to deliver $900 million more in adjusted net income, which would require about $1.125 billion more in earnings from continuing operations before tax. GE could conceivably pick up $100 million or more from a lower tax rate (in the high teens, which would be within its guidance range). The rest would have to come either from segment EBITDA that is better than what I have projected here or lower costs below the Industrial EBITDA line (e.g. corporate, interest, depreciation and amortization, etc.). Since GE’s guidance reflects only the 20Q1 impact of COVID-19, it seems unlikely that segment EBITDA will be significantly better than what I have projected here and more likely that it will be worse.

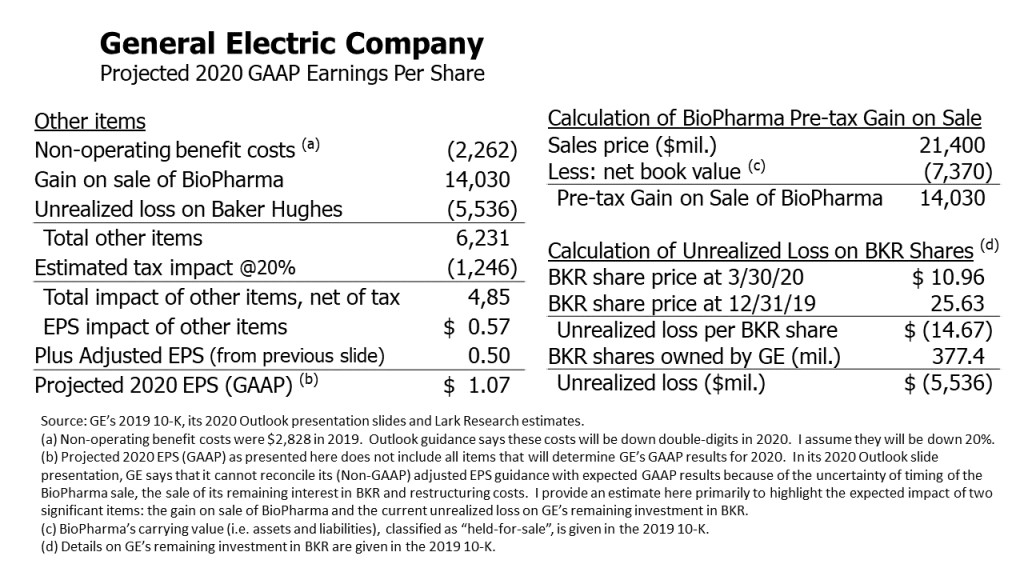

The table above provides a rough estimate of GE’s projected GAAP earnings for 2020. I have furnished it to show a couple of line items that will have a big impact on GE’s GAAP earnings this year: the gain on the sale of BioPharma and the unrealized loss on GE’s remaining 36.8% equity stake in Baker Hughes (BKR). According to GE’s 10-K disclosures of the carrying values of BioPharma’s assets and liabilities, I estimate that the pre-tax gain on sale will be $14 billion. Partially offsetting this gain will be an unrealized loss on its remaining interest in BKR, which is accounted for at fair value. I estimate this pre-tax loss at $5.5 billion.

Besides these two items, I also pick up in this calculation those non-operating benefit costs, which are excluded from the calculation of (Non-GAAP adjusted EPS). My 2020 estimate for these costs is down 20% from 2019, which is consistent with management’s expectations of a double-digit decline.

To these three items, I apply a tax rate of 20%, which is equivalent to the rate that I apply to GE’s adjusted pre-tax earnings from continuing operations. That assumption will almost certainly be wrong. Tax rates on asset sales are based upon their book value for tax purposes, which quite often differs from the statutory tax rate. For example, GE’s tax rate on the loss that it recognized from deconsolidating Baker Hughes in 2019, which included the previous BKR common stock offering, was about 5.5%. I use the standard tax rate here because I have no basis for assuming a different rate.

Assessing the Impact of COVID-19. As noted, GE’s guidance was given in early March, before the potential consequences of COVID-19 became apparent to most people (including me), and especially to the financial markets. In response to the realization that it would take a big chunk out of economic activity, the S&P 500 has fallen 16.1% since then, after bouncing off the lows when it was down 21.8%.

Industries affected directly by the fear of contagion include all travel-related sectors, especially the airlines. Over the past 30 days (to March 27), the Dow Jones travel-related sector indices have fallen 26.0%-46.5%. Airline stocks have lost 36.1% of their value. Boeing’s stock has plunged 47%, (after being down nearly 70%).

Since GE derives 70% of its segment earnings from Aviation, its stock has mirrored the performance of the airlines and Boeing, falling sharply during most of the month, but then bouncing back recently as the Federal government’s $2 trillion rescue package has taken shape. Still, over the past 30 days (to March 27), GE’s stock is down 30.4%.

The plunge in GE and these other stocks echoes the steep decline in air travel that has occurred in the U.S. and around the globe. Airlines will cut scheduled flights in April by as much as 60% and maybe more in the months ahead. Plummeting air travel can hurt GE Aviation in two ways: by reducing the demand for new aircraft and by lowering maintenance shop visits on aircraft engines. If it infects a sufficient number of workers, COVID-19 could also disrupt the supply chains and manufacturing schedules for GE, its joint venture partner, CFM International, and the aircraft makers.

Obviously, these potential risks will become more consequential the longer COVID-19 interrupts daily life. If the airlines become squeezed financially, they will seek to push back or even cancel aircraft orders. For now, GE is most focused on the Boeing 737 Max’s long anticipated return to service by mid-year. GE management is highly confident that this will occur. If it does, Boeing will be able to release its inventoried MAXs and restart its production lines.

If the negative impact of COVID-19 stretches beyond the summer, the cumulative effect of the slowdown in air travel will begin to weigh more heavily on Aviation’s equipment and service revenues. The 35% decline in air travel in Asia through the end of the first quarter has been incorporated into GE’s 2020 full year guidance; but management has not incorporated any effects beyond the first quarter because the wide range of potential outcomes.

Besides Aviation, GE’s other businesses will feel the effects of COVID-19. The Europeans have seen 5%-15% declines in electric power usage since the onset of the crisis. The decline is being driven by a drop in commercial and industrial demand, partially offset by increasing residential usage. Assuming that similar percentages hold in the U.S., GE’s merchant power and utility customers could be challenged both by a decline in wholesale power prices, since most U.S. markets are already well supplied, and also by the overall reduction in retail electricity volume. For GE Power, deteriorating market fundamentals could prompt gas turbine buyers to seek to stretch out deliveries, slow new orders and scale back maintenance services.

GE Renewable Energy may also be hurt by COVID-19, but probably less so than Power, because wind farm operators typically take a long-term view on decisions to add capacity. Nevertheless, the decline in electricity demand and wholesale power prices could cause operators to delay new projects. 2020 demand should not be affected because project sponsors are racing to beat the PTC deadline, but there may be delays in completing projects, due to supply chain disruptions and labor shortages. The American Wind Energy Association failed to get Congress to include an extension of the PTC in the recently passed $2 trillion bailout legislation, but it will keep trying.

As noted, GE Healthcare will derive some benefit from COVID-19 through increased demand and utilization of certain products, such as CTs, ultrasound devices, mobile X-ray systems, patient monitors and ventilators. It has formed a partnership with Ford Motor Company to manufacture ventilators, but it is unclear just how many ventilators will be produced under this arrangement and whether GE Healthcare will derive any financial benefit from it. (On March 27, President Trump ordered General Motors to make ventilators under the Defense Production Act.) Other Healthcare products, however, may see lower sales and utilization temporarily, as healthcare providers focus their resources on healing infected patients.

At this time, the consensus economic view (with which I agree) anticipates that COVID-19 will cause a contraction in economic activity in the second and third quarters; but the economy should begin to rebound by the end of summer and extend its gains in the fourth quarter and beyond. Although the long-term impact of the $2 trillion rescue package is unclear, it almost certainly will limit the downside in economic activity in 2019 and probably lift the economy well into 2021.

The bailout bill includes $25 billion in grants and $25 billion in loans to the passenger airline industry. It allows (but does not require) the Federal government to take equity stakes in airlines in exchange for cash grants. It also includes $17 billion for aid to industries that are critical for maintaining national security, which could include Boeing.

Despite the general expectations among economists of a two-quarter slide in economic activity, there is considerable uncertainty about the earnings outlook for most companies, including GE. The consensus of sell-side analysts, according to S&P Global Market Intelligence (“SPGMI”) anticipates 2020 adjusted EPS right around $0.50, which is right at the low end of management’s March 4th guidance. The 2020 first quarter consensus of $0.10, which reflects some of the impact from COVID-19, is also consistent with management’s guidance.

Based upon recent developments, GE’s first quarter earnings could come in below the $0.10 first quarter consensus. Unless there is clear evidence that COVID-19 has been contained and economic activity is beginning (or will soon begin) to return to normal, GE, like other companies, may withdraw its 2020 guidance.

Under the circumstances, it is likely that GE’s 2020 adjusted EPS will come in below its most recent guidance of $0.50 and possibly a lot lower. It would not be surprising to see actual adjusted EPS come in $0.10-$0.20 lower.

Even so, as long as clear signs of a return to economic normalcy begin to surface sometime during the summer, I believe that the financial markets will begin to look through these lower earnings and anticipate improved performance later in the 2020 fourth quarter and in 2021. In that case, I would expect GE’s stock to begin to move back toward its pre-COVID-19 level, perhaps before management confirms or reinstates its 2020 earnings guidance.

Other Posts in this “Deep Dive on GE” series:

The 2020 Outlook for Its Businesses (March 31, 2020)

Consolidated Enterprise Valuation (March 31, 2020)

GE Capital (April 3, 2020)

Sum-of-the-Parts Valuation (April 5, 2020)

March 31, 2020

Stephen P. Percoco

Lark Research

839 Dewitt Street

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2015-2024 by Stephen P. Percoco, Lark Research. All rights reserved.

This blog post (as with all posts on this website) represents the opinion of Lark Research based upon its own independent research and supporting information obtained from various sources. Although Lark Research believes these sources to be reliable, it has not independently confirmed their accuracy. Consequently, this blog post may contain errors and omissions. Furthermore, this blog post is a summary of a recent report published on this subject and that report provides a more complete discussion and assessment of the risks and opportunities of any investment securities discussed herein. No representation or warranty is expressed or implied by the publication of this blog post. This blog post is for informational purposes only and shall not be construed as investment advice that meets the specific needs of any investor. Investors should, in consultation with their financial advisers, determine the suitability of the post’s recommendations, if any, to their own specific circumstances. Lark Research is not registered as an investment adviser with the Securities and Exchange Commission, pursuant to exemptions provided in the Investment Company Act of 1940. This blog post remains the property of Lark Research and may not be reproduced, copied or similarly disseminated, in whole or in part, without its prior written consent.