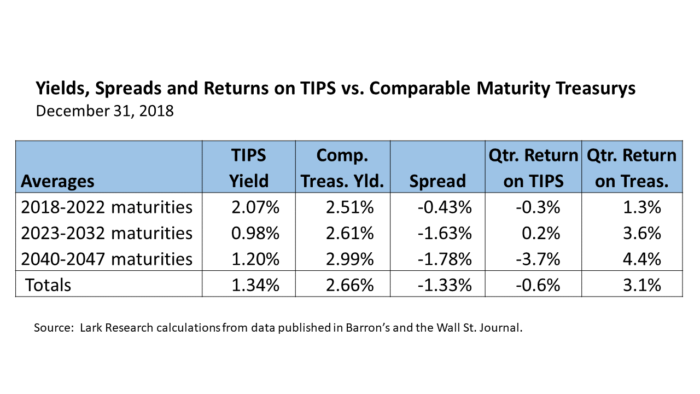

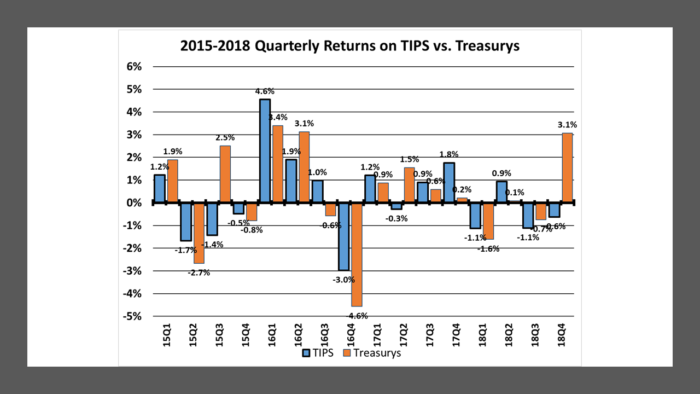

- TIPS on average lost 0.6% in the 2018 fourth quarter, much worse than the 3.1% gain in comparable maturity straight Treasurys.

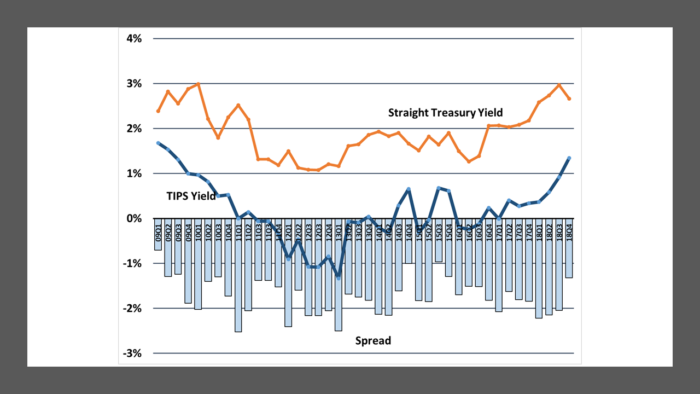

- The average breakeven spread fell 73 basis points (bp) to 132 bp, well below the long-term average of 174 bp.

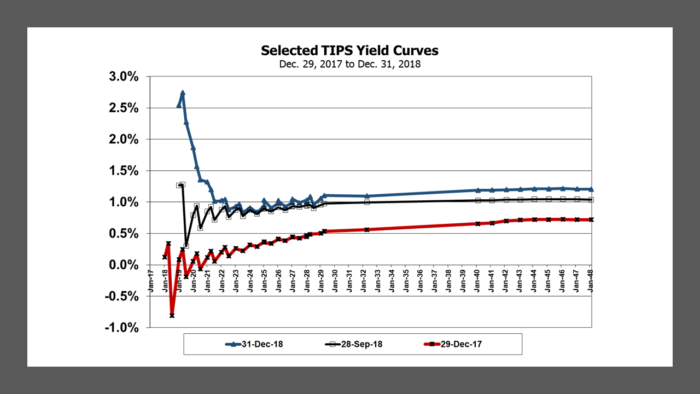

- The sharp rise in the short-term TIPS yields reflect lower near-term inflation expectations.

- Since year-end, TIPS have rallied back, while Treasurys have slipped slightly, raising the spread back to 173 bp.

- I view TIPS as a better value over the long-term because I believe that inflation will average more than 174 bp.

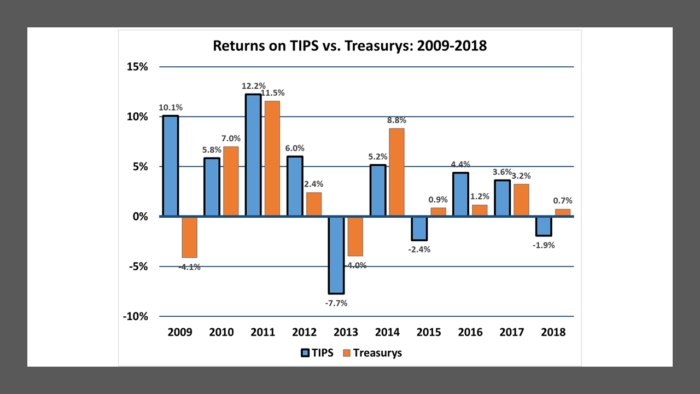

TIPS underperformed comparable maturity straight Treasurys for the second consecutive quarter; this time by a wide margin. On average, TIPS lost 0.6% in the third quarter compared with a 3.1% gain on comparable maturity straight Treasurys. The average yield on TIPS rose by 42 basis points (bp) to 1.34%, compared with the 31 bp decline to 2.66% for Treasurys. As a result, the average spread between straight Treasurys and TIPS yields declined by 73 bp from 205 bp to 132 bp.

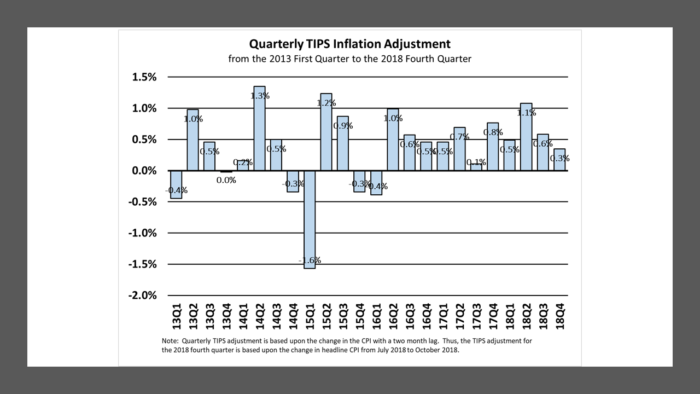

The rise in TIPS yields and sharp decline in the average spread suggests that inflation expectations moderated significantly during the quarter. The quarterly TIPS adjustment for the 2018 fourth quarter declined to 0.35% from 0.58% in the 2018 third quarter. In addition, the plunge in the price of oil from a high of $77 in early October to a low of $42 in late December almost certainly dampened expectations about near-term inflation. As would be expected, investors sought a higher yield on TIPS to compensate for a lower anticipated inflation adjustment.

Once again, the returns on longer maturity securities were more volatile. Long-maturity TIPS suffered a 3.7% decline, while longer-term straight Treasurys posted a 4.4%% gain. The returns on shorter maturity TIPS and Treasurys were more subdued; but short-term Treasurys still managed to post an attractive 1.3% gain, according to my calculations.

As already noted, the gain in TIPS from the inflation adjustment eased again from the 2018 third quarter. Since headline CPI declined by 0.65% from October to December, odds are that the inflation adjustment will be negative in the 2019 first quarter.

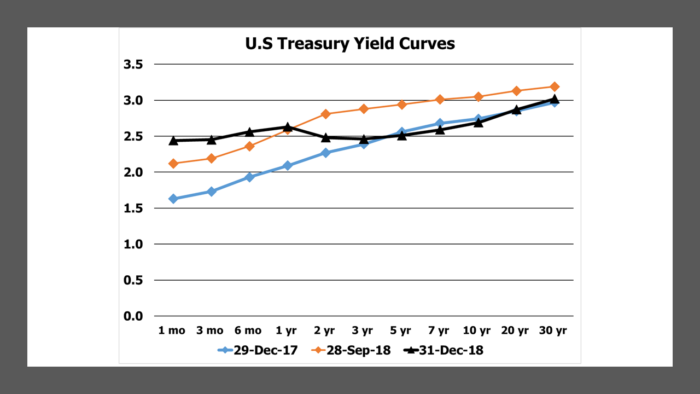

Like straight Treasurys, the US TIPS yield curve flattened in 2018, even though very short-term TIPS yields have risen sharply. During the fourth quarter, the TIPS yield curve shifted higher by 7 basis points across intermediate maturities and 16 basis points across the long maturities. By contrast, intermediate Treasury yields fell by 38 basis points and long-term Treasury yields eased by 21 basis points.

The average yield spread between straight Treasurys and TIPS plunged during the quarter by 73 bp from 205 bp to 132 bp, and is now well below the long-term average spread of 174 bp.

The spread between the 10-year U.S. Treasury yield and the 2-year yield has narrowed again from 24 bp at the end of September to 21 bp at the end of December. That spread declined 26 bp during 2018. The rate of flattening slowed during the fourth quarter.

At its most recent meeting in December, the Federal Open Market Committee (FOMC) as expected raised the target range for the Fed Funds rate by a quarter basis point to 2.25%-2.50%. In its statement, the FOMC highlighted the continuing strength in the labor market and consumer spending, while noting that business investment had slowed from earlier in the year. If economic growth continues at the current pace, the labor market remains strong and inflation remains near its target of 2%, the FOMC said that “some further increases” in the Fed Funds rate would be warranted.

In recent weeks, the financial markets have rallied on statements by FOMC officials, especially Chairman Powell, that its decisions to raise rates would be considered in light of incoming data. This is really nothing new, since the FOMC has almost always considered current and future expected economic developments and activity in making its interest rate decisions.

January’s employment data will almost certainly incorporate the impact of the shutdown of the Federal governments, since many Federal workers have recently filed for unemployment. The current consensus seems to expect that the shutdown will not continue for long, since key Federal workers like the air traffic controllers and FBI are next up to be furloughed. If, however, the Administration and Congress allow the dispute to drag on, the effect on overall employment will be significant. In that event, while it is easy to conclude that economic growth would suffer, the overall response of the financial markets is more difficult to predict.

These uncertainties will be an important determinant of the performance of TIPS versus US Treasurys. Despite those uncertainties, the low spread of 132 basis points between Treasurys and TIPS suggested that TIPS were a much better relative value. As it turns out, however, the financial markets recognized this and adjusted very quickly. In the first eight trading days of the year (through Jan. 11), TIPS have rallied by about ¾ of a point, while comparable maturity Treasurys have fallen by less than ¼ point. The price moves have lowered TIP yields and raised Treasury yields so that the spread is now about 173 basis points, which is near the long-term average. Over the longer-term, I believe that inflation is likely to average more than 173 basis points, which would make TIPS the better relative value, but shorter term moves are difficult to predict.

January 13, 2019

Stephen P. Percoco

Lark Research

16 W. Elizabeth Avenue, Suite 4

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2019 by Lark Research. All rights reserved. Reproduction without permission is prohibited.