GE reported 23Q2 revenues of $16.7 billion, up 18.2% year-over-year; GAAP EPS from continuing operations of $0.91, compared with 22Q2’s $1.09 loss; and non-GAAP EPS of $0.68 vs 22Q2’s $1.14. I had anticipated GAAP EPS of $0.23 per share and non-GAAP EPS of $0.46.

All three businesses – Aerospace, Renewable Energy and Power – showed meaningful improvements in sales and segment profit (loss) both sequentially and YOY. Aerospace and Renewable Energy also had significant increases in unit sales volumes. Based upon this much stronger-than-anticipated performance, the company raised its 2023 guidance. It now anticipates low double-digit revenue growth (vs. high single-digits previously), adjusted (non-GAAP) EPS of $2.10-$2.30 (up from $1.70-$2.00) and free cash flow of $4.1-$4.6 billion (up from $3.6-$4.2 billion).

GE also continues to take steps to reduce complexity and clean up some of the distractions that have been hurting its performance. It approved a $1.0 billion settlement program for borrowers in its Polish mortgage portfolio which should put an end to litigation that has cost the company $2.6 billion so far. It also plans to retire all outstanding preferred stock in September (at a cost of $3.0 billion).

Based upon GE’s revised guidance, I now anticipate 2023 GAAP diluted EPS of $7.69 and adjusted non-GAAP earnings of $2.32, which is above management’s guidance but slightly below consensus.

I have also raised my range estimate of GE’s break-up value from $93-$123 per share previously to $102-$126. The increase mostly reflects improved profitability, a small increase in the low end of the valuation multiple range for GE Aerospace and a reduction in debt outstanding. The $114 midpoint of the new valuation range represents a potential return of about 2% from the current price of $112.17. Consequently, I am maintaining my performance rating of “3” (Neutral). The actual value of GE after the spin-off will of course depend upon market conditions in early 2024 as well as any further changes in its performance and outlook. Given this quarter’s surprisingly strong performance, the company’s sales and earnings momentum looks set to continue for at least the next few quarters.

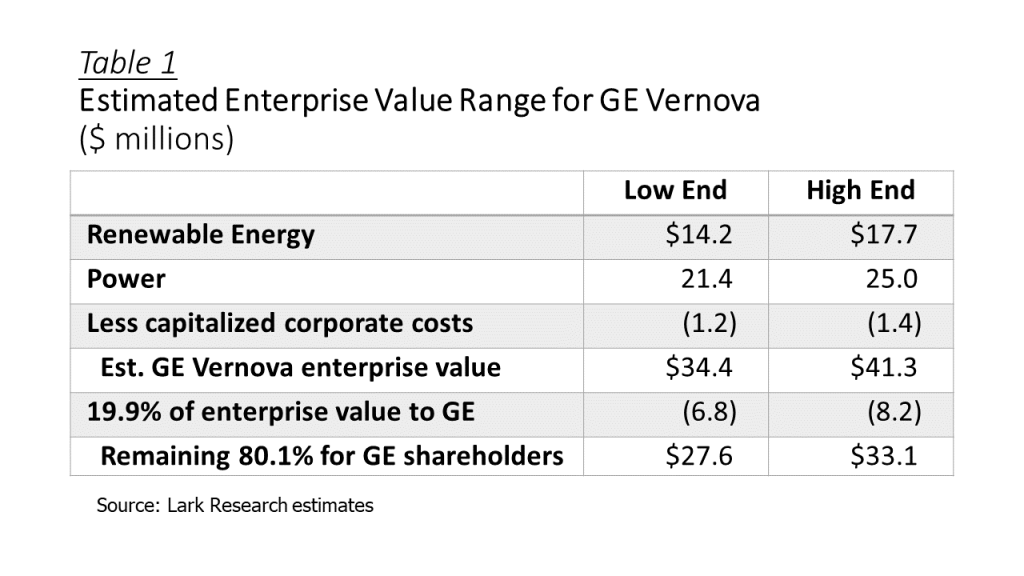

The Spin-Off of GE Vernova. My revised break-up valuation for GE is detailed in the tables below. Assumptions have been updated for current values as of August 9, 2023.

I have increased my valuation estimates for GE Vernova by ~$2 billion, due to improved sales and reduced losses at Renewable Energy and modestly improved profitability at Power. Renewable Energy is valued at 1.0-1.25 times revenue and Power at 12-14 times trailing 12-month (TTM) EBITDA. I have also raised the low end of the EV-to-EBITDA multiple range for GE Aerospace from 12 to 13 based upon peer valuations. (So the multiple now ranges from 13 at the low end to 16 times TTM EBITDA at the high end.) Together with the improvement in GE Aerospace’s profitability, my valuation estimate has increased at the midpoint by 13% to $94.6 billion. Value estimates for the equity stakes in AER and GEHC reflect recent stock sales by GE and changes in their share prices. Debt outstanding declined from $22.4 billion in 23Q1 to $21.8 billion in 23Q2. These changes produce a valuation estimate of $101.96-$126.27 per GE share (up from $93.38-$122.80 previously). At the midpoint, the valuation is $114.14.

This is a summary of my recent report on General Electric Company (GE), originally published on August 9, 2023. To obtain a copy of the full report, please reach out to me using the contact information provided below.

August 17, 2023

Stephen P. Percoco

Lark Research

839 Dewitt Street

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2015-2025 by Stephen P. Percoco, Lark Research. All rights reserved.

This blog post (as with all posts on this website) represents the opinion of Lark Research based upon its own independent research and supporting information obtained from various sources. Although Lark Research believes these sources to be reliable, it has not independently confirmed their accuracy. Consequently, this blog post may contain errors and omissions. Furthermore, this blog post is a summary of a recent report published on this subject and that report provides a more complete discussion and assessment of the risks and opportunities of any investment securities discussed herein. No representation or warranty is expressed or implied by the publication of this blog post. This blog post is for informational purposes only and shall not be construed as investment advice that meets the specific needs of any investor. Investors should, in consultation with their financial advisers, determine the suitability of the post’s recommendations, if any, to their own specific circumstances. Lark Research is not registered as an investment adviser with the Securities and Exchange Commission, pursuant to exemptions provided in the Investment Company Act of 1940. This blog post remains the property of Lark Research and may not be reproduced, copied or similarly disseminated, in whole or in part, without its prior written consent.