On June 26, General Electric (GE) announced the outcome of its strategic review. Besides divestiture actions already announced, the company said that it will spin-off its Healthcare business over the next 12-18 months and distribute its 62.5% stake in Baker Hughes, a GE company (BHGE) over the next two to three years. Those actions would leave GE with three core businesses – Aviation, Power and Renewable Energy.

GE also plans to shrink its corporate headquarters operations, leaving it with four primary functions: strategy, capital allocation, human resources and governance. Other services typically performed at headquarters will be delegated to the operating businesses. The company expects to reduce corporate expenses by $500 million annually by the end of 2020.

In conjunction with these moves, GE said that it plans to reduce Industrial net debt by $25 billion, while maintaining $15 billion of cash on the balance sheet. This should bring its ratio of Industrial net debt-to-EBITDA to less than 2.5 times by 2020.

Previously, GE had announced plans to sell $20 billion of assets, including its Transportation and Lighting businesses. During the second quarter, the company completed the sale of Healthcare’s Value-Based Care business for $1.05 billion in cash and the Power’s Industrial Solutions business for $2.6 billion, including $1.9 billion of cash and $0.7 billion of related GE Capital receivables. In May, the company announced the sale of its Transportation business to Wabtec for $10 billion. In June, it announced an agreement to sell the Distributed Power business for $3.25 billion. That brings total announced sales to date to $16.9 billion. Not included in that total was the sale of the GE Lighting business in Europe, the Middle East, Africa and Turkey and its Global Automotive Lighting business which was completed for an undisclosed amount in the 2018 second quarter.

GE previously said that it would sell its Current and Lighting business by the end of the year. With the sale of the international lighting business, only the U.S. business remains. It has been exploring the sale of various smaller Aviation platforms. It is also looking to shrink GE Capital’s assets by about $25 billion, up from $15 billion just a couple of months ago. Previously, the company had said that it expected to complete about half of the $15 billion of GE Capital asset sales by the end of the year. Most of the declines will come from Energy Financial Services and Industrial Finance businesses.

Sale of GE Transportation. In May, GE announced that its Transportation business will be sold to Wabtec (NYSE:WAB) for an estimated $10.0 billion, excluding $1.1 billion of tax benefits that will accrue to the combined companies. The $10.0 billion purchase price includes $2.9 billion of cash and $7.1 billion of Wabtec stock, equivalent to a 50.1% stake in the combined companies, based upon Wabtec’s closing share price on April 19. The sale is expected to be completed in early 2019.

Under the merger agreement, GE is required to distribute to its shareholders 80.25% of its 50.1% stake (which is equivalent to a 40.2% stake in the combined companies). The distribution can take the form of a one-step spin-off or exchange offer followed by a clean-up spin-off. That would leave GE with a 9.9% stake in new Wabtec, which can be monetized after a 90-day lock-up period. GE is required to sell its remaining stake in the combined company within three years.

Since the deal was announced, Wabtec shares have risen steadily. On July 27, its share price closed at $108.36, up 29.3% from the April 19 closing price of $83.79, upon which the transaction was valued. At the current share price, the equity portion of the deal is now worth $9.18 billion, bringing the total transaction value, excluding the $1.1 billion of tax benefits, to $12.1 billion.

Separation of GE Healthcare. As noted above, GE plans to separate from GE Healthcare within the next 12-18 months. The company said that it will monetize 20% of Healthcare’s equity value and distribute the remaining 80% to shareholders. GE also plans to allocate $18 billion of debt and/or pension obligations to Healthcare as part of the separation.

I have attempted to estimate the value of the Healthcare business below. Directly comparable companies are difficult to find, primarily because each company has a unique business mix. GE Healthcare has significant positions medical imaging (e.g. MRIs), patient monitoring and diagnostics and its major competitors in those businesses are mostly subsidiaries of large companies located outside the U.S. (e.g. Siemens, Fujifilm Holdings, Toshiba, Hitachi and Philips). One U.S. competitor, Hologic (NYSE:HOLX), focuses primarily on diagnostics for women, but it is considerably smaller than GE Healthcare.

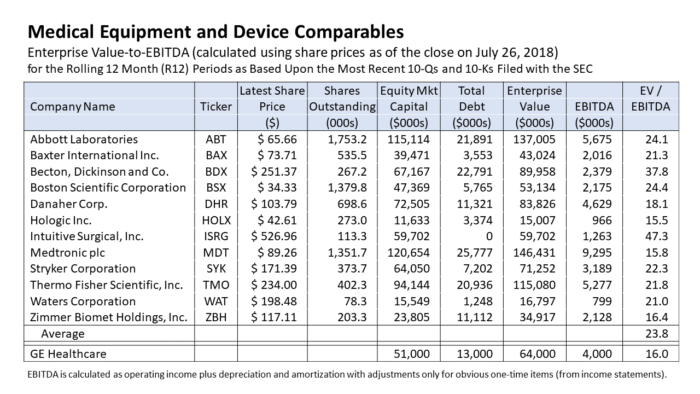

With this caveat, I have provided a list of comparable medical equipment and device manufacturers below. On a rolling 12 month basis (using the latest available quarterly SEC filings), this group has an average enterprise-to-EBITDA multiple of 24.7, ranging from a low of 15.5 for Hologic to a high of 47.3 for Intuitive Surgical (NYSE:ISRG).

I assume an enterprise value-to-EBITDA multiple of 16.0 for GE Healthcare, which is at low end of the range and seems conservative. With projected 2018 EBITDA of $4.0 billion, which reduces projected segment EBITDA by an estimated $400 million for corporate and other costs (e.g. non-operating benefit costs) that will be transferred to or assumed by Healthcare, my estimated enterprise value is $64.0 billion.

As already noted, GE plans to transfer $18 billion of debt and/or pension obligations to Healthcare before the spin-off. By pension obligations, I am assuming that the GE means GE Healthcare’s share of the underfunded pension and OPEB plans, rather than its share of the company’s combined projected benefit obligations (PBOs). At the end of 2017, GE had a combined pension and OPEB PBO of $100 billion, which was underfunded by $28.7 billion. I roughly estimate GE Healthcare’s share of these pension obligations to be equivalent to the ratio of GE Healthcare employees to total company employees. At the end of 2017, GE Healthcare had 52,000 employees, equal to 16.6% of GE’s total of 313,000 employees. Its estimated share of the PBOs is therefore $16.6 billion and its share of the underfunding is $4.8 billion.

Using the estimated $4.8 billion – let’s call it $5.0 billion – of pension/OPEB underfunding, I then estimate that GE plans to transfer $13.0 billion of debt to Healthcare. Actually, rather than transfer debt from GE parent to Healthcare, it is much more likely that Healthcare will instead issue $13.0 billion of debt and transfer the proceeds as a dividend back to the parent. GE could then either keep the cash or pay down $13.0 billion of its own debt by $13.0 billion. Either way, GE’s net debt would be reduced by $13.0 billion, which is more than half of its $25 billion net debt reduction target.

The monetization of 20% of Healthcare’s equity would presumably take the form of an initial public offering of Healthcare’s stock. Under my valuation assumption, this IPO would raise 20% of the estimated equity value of $51.0 billion or $11.0 billion, before underwriting fees and other expenses. With the debt transfer of $13.0 billion and IPO proceeds of $11.0 billion, GE would substantially achieve its $25.0 billion net debt reduction target just on the separation of Healthcare, without considering any cash proceeds raised from the sale of Transportation, the sale of its remaining 62.5% equity stake in BHGE or any free cash flow generated from operations.

Separation of BHGE. GE’s other major announced portfolio move is the planned orderly separation of Baker Hughes, a GE Company (BHGE) over the next 2-3 years. According to my calculations, at the July 27 closing price of $34.73, the 37.5% equity interest in BHGE that is publicly traded is currently worth $14.5 billion. That suggests that the remaining 62.5% economic interest owned by GE is worth $24.1 billion.

The longer time frame for distributing an estimated equity value that is half Healthcare’s suggests that GE intends to sell its BHGE equity interest over time in more than one step. This is similar to what the company did with its remaining Genworth stake. Monetizing its equity stake in increments may help GE get the highest value for its BHGE equity position. With optimism increasing about the prospects for oilfield service companies, GE may be able to sell into strength.

GE’s Pro Forma Valuation. Using the valuation estimates for the businesses that are slated to be sold or spun-off, I seek to assess the implied value that the equity market is giving to its remaining businesses. A summary of that analysis is given in the slide below.

First, I start with a projection of industrial segment EBITDA (including corporate expenses) for 2018. To keep things simple, I am excluding GE Capital from this analysis. (Said another way, I am assuming that the value of GE Capital is zero.) My 2018 projections are consistent with management’s adjusted EPS guidance of $1.00-$1.07. A table that reconciles EBITDA to adjusted EPS is provided at the end of this post.

My pro forma figures assume the completion of the sale and spin-offs of BHGE, Healthcare, Transportation and Lighting. (It appears that Lighting’s value is not large enough to sway the overall figures, so I am ignoring it in this analysis.) In addition, I assume that corporate expenses (including non-operating benefit costs) will be reduced by 30%, less than the 39% assumed projected decline in 2018 EBITDA from the spin-offs. A 30% reduction in corporate overhead equals $1.26 billion, which incorporate the company’s recently announced plan to cut corporate overhead by an additional $500 million by 2020 and also includes implicit reductions in non-operating benefit costs that presumably will be parceled out to the spin-offs.) Net of these corporate and other items, I estimate that the remaining Power, Renewable Energy and Aviation business will produce $8.5 billion of EBITDA in 2018.

At Friday’s (7/27) closing price of $13.06, GE has enterprise value (on industrial debt only) of $184.4 billion and an equity market value of $113.4 billion. Excluding the combined estimated value of $100.2 billion for the Transportation and Healthcare segments and the 62.5% stake in BHGE, GE has a pro forma enterprise value of $84.2 billion and equity market value of $26.2 billion. (This equity value estimate assumes that $13 billion of GE’s industrial debt is “transferred” to Healthcare.)

Following the segment divestitures, with estimated 2018 pro forma industrial EBITDA of $8.5 billion, GE’s ratio of enterprise value-to-EBITDA would be 10.0 times. This seems low, especially since GE’s Aviation business, the global leader in aircraft engines, which is at the top of its game and has at least several more years of solid growth assuming no change for the worse in the global economy, would probably be valued at 15-20 times EBITDA. Even GE’s beleaguered Power segment, which is not expected to see its profits rebound until 2019 or later, would likely trade at a higher multiple than 10, assuming that its sustainable EBITDA is higher than that projected for 2018.

If GE’s pro forma 2018 EBITDA is valued at 15 times, its pro forma equity market capitalization would $68.8 billion, which is $42.1 billion higher than 10 times EBITDA valuation estimate given above. A $42.1 billion increase in GE’s current equity valuation would equate to $17.91 per GE share.

Of course, there are many facets to this remaking of GE, each of which must be executed successfully in order for the company to reach its goal and achieve a higher valuation. These include the completion of the segment sales/spin-offs at the anticipated valuations, further cost-cutting and at least stabilizing the Power segment’s performance; but there is also upside, I believe, to my value estimates for both the Healthcare and Oil & Gas businesses and the performance of the remaining businesses.

Other Issues. Assuming that GE follows through on its plans, it will have to address other financial issues. My pro forma equity valuation of $26.2 billion implies a share price of about $3.00 with the current number of shares outstanding. (Most of the difference from the current share price of $13.06 or roughly $10 per share will be paid out to shareholders.) At 15 times pro forma EBITDA, GE’s share price would be $7.91, which is still below the $10 level typically required by institutional investors.

Consequently, as GE proceeds with the spin-offs, it will also be looking for ways to reduce its share count. One way to achieve this is through direct exchange offers of spin-off shares for GE shares. GE used this technique in the Synchrony spin-off. The Transportation segment’s merger agreement with Wabtec allows it to make a similar exchange offer followed by a clean-up spin-off of the remaining Wabtec shares to its shareholders. GE will almost certainly pursue similar exchange offers, followed by clean-up spin-offs, for Healthcare and BHGE.

Even so, it will be virtually impossible to exchange $51 billion exchange of Healthcare shares. Consequently, GE may also pursue other alternatives, such as share buybacks or even a reverse split if necessary to get its share price above $10.

GE has also said that it will continue to pay the current annual dividend rate of $0.48 on its shares until its completes the Healthcare separation. Since it will be reducing its EBITDA by nearly 40% as a result of all of these planned separations, the company will reduce its dividend perhaps by as much as a similar percentage at the time. The actual reduction in the dividend will also depend upon the performance outlook for its remaining businesses at the time of the Healthcare spin-off.

July 29, 2018

Stephen P. Percoco

Lark Research

839 Dewitt Street

Linden, New Jersey 07036

(908) 448-2246

admin@larkresearch.com

© Lark Research, Inc. All rights reserved. Reproduction without permission is prohibited.