Back to Index

Back to The Yield Curve

Next Topic: Yield Spreads: A Measure of Comparative Value

Treasury Inflation-Protected Securities (TIPS) are issued by the U.S. Treasury and designed to appeal to investors who want protection against inflation. Their return consists of two components: a current rate of interest plus an inflation adjustment based upon the change in the Consumer Price Index and added to principal every six months. The current interest rate is therefore equal to the real rate of interest, the return earned over and above the rate of inflation.

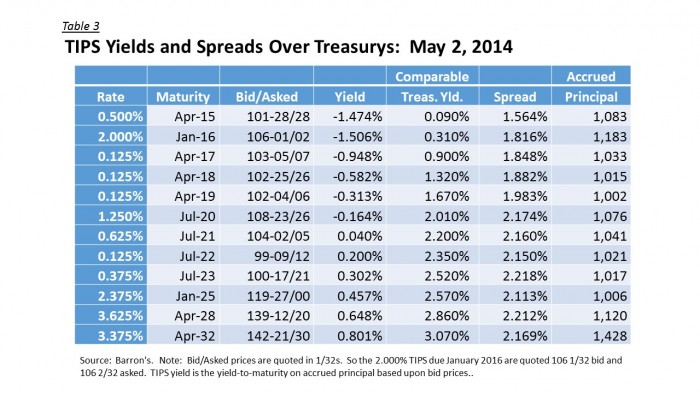

Investors often compare the yield on TIPS (which excludes the inflation-adjustment) to the yield on the comparable maturity Treasury security. This is called the “breakeven inflation rate.” So for example, on May 2, 2014, the yield on the 0.125% TIPS due April 2018 was -0.582%, while the average yield on the Treasury notes maturing around April 2018 was 1.32%. The spread between the two, equal to 188 basis points or 1.88%, is the breakeven inflation rate.

As of May 2, 2014, if inflation, as measured by the CPI, averages more than 1.88% per year over the four years from 2014 to 2018, the April 2018 TIPS would earn a higher return. If inflation is less, then the straight Treasury Note would earn a higher return.

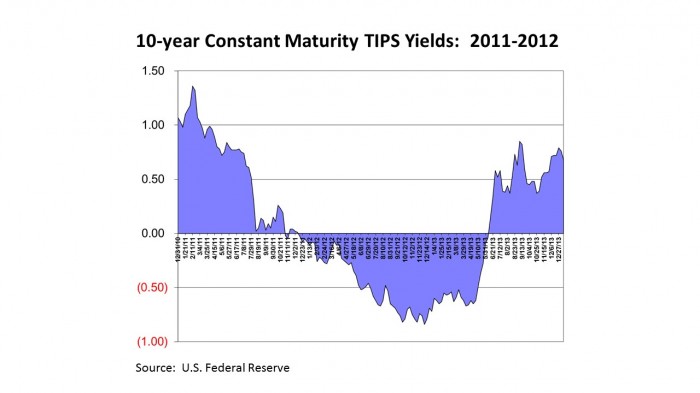

The following charts show the change in the TIPS yields, for 5-year and 10-year maturities, since 2011.

From the beginning of 2011, as yields on straight Treasury notes and bonds continued to fall, the yield on the 5-year TIPS declined from about breakeven to a low of -1.50% by the fall of 2012. The yield remained roughly around that level until April 2013, when the Chairman of the Federal Reserve hinted that the tapering of the Fed’s Quantitative Easing bond buying program would soon begin. From that point, 5 -year TIPS yields rose (i.e. became less negative); so that in May 2014, they were once again hovering around breakeven.

10-Year TIPS yields also bottomed out in the fall of 2013 at about -0.75%. They have since climbed back to about 0.40% (as of May 2014).

Since the Federal Reserve began the process of winding down QE, TIPS yields have been volatile. As interest rates have begun to normalize, interest rates on TIPS have risen. This drove negative returns on TIPS during three of the four quarters of 2013 and a negative return for the full year. If interest rates continue to normalize and inflation expectations remain well anchored, TIPS returns could remain negative for a while.

Back to Index

Back to The Yield Curve

Next Topic: Yield Spreads: A Measure of Comparative Value

________________________________________________________________________________________________

Updated May 8, 2014

Stephen P. Percoco

Lark Research

16 W. Elizabeth Avenue, Suite 4

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2014 Lark Research, Inc. All Rights Reserved. Information is carefully compiled but not guaranteed to be free from error. Specific reference to any specific security should never be construed as a solicitation to either buy or sell. Reproduction without permission from the publisher is prohibited.