Back to Index

Next Topic: Fixed Income Sectors

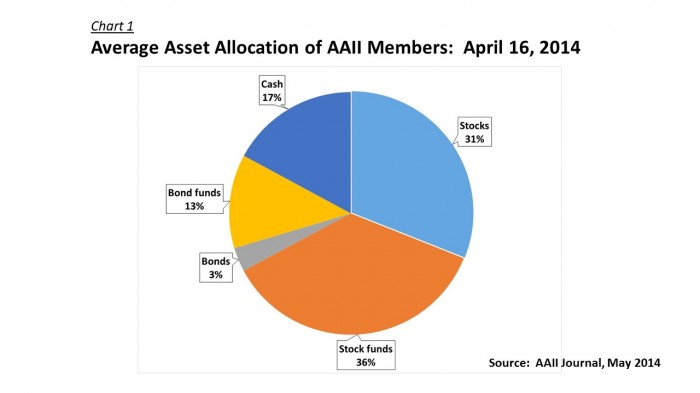

Despite significant inflows into fixed income in recent years, most individuals have just built back their exposure to long-term average levels. In April 2014, the average member of the American Association of Individual Investors allocated just 16% of his (or her) portfolio to bonds or bond funds. This compares with a 67% weighting in individual stocks or stock funds and 17% in cash. His allocation to bonds had risen from just 9% in 2008 in the months preceding the financial crisis. He has raised his exposure to fixed income in the years since the crisis, but mostly by reducing their cash holdings. The current weighting of 16% in bonds is in line with long-term averages, according to AAII.

The self-selected members in AAII’s asset allocation poll may be atypical. Compared to the average investor, they are much more likely to buy individual stocks. Nevertheless, most individual investors carry a low fixed income weighting in their portfolios. Relatively few investors consider the full range of fixed income securities as investment options.

Despite the risk of rising interest rates from their current low levels, investors should pay more attention to fixed income. It is still possible to earn solid, inflation-adjusted returns with less downside risk in certain pockets of the fixed income markets. In addition, emerging trends in the financial markets often show up early in the fixed income sector; so focusing on fixed income will make you a better stock investor.

Back to Index

Next Topic: Fixed Income Sectors

____________________________________________________________________________

Updated May 8, 2014.

Stephen P. Percoco

Lark Research

16 W. Elizabeth Avenue, Suite 4

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2014 Lark Research, Inc. All Rights Reserved. Information is carefully compiled but not guaranteed to be free from error. Specific reference to any specific security should never be construed as a solicitation to either buy or sell. Reproduction without permission from the publisher is prohibited.