Back to Index

Back to Real Interest Rates and Yields on TIPS

Next Topic: Credit Analysis: The Key to Protecting Principal

To compare the relative value of one bond against another, investors typically look at bond spreads.

For example, if Verizon Communication’s 5.15% Notes due 9/15/2023 are trading at 111 to yield 3.75% and the comparable 9 1/2-year Treasury is yielding 2.55%, then the spread on the VZ 5.15s is120 basis points.

Since Verizon is a BBB+-rated credit, the spread on the 5.15s should be compared against other similarly rated bonds. Several major brokerage firms maintain a variety of corporate bond indexes that facilitate such comparisons. In our case, the Barclays Capital U.S. Corporate BBB-rated index carried a spread of 130 basis points. (See Chart 8 below.) So Verizon’s 120 basis point spread is priced about right.

An investor considering the purchase of Verizon bonds would want to consider fundamental factors – such as whether he or she thinks that the company will be able to meet its goal of using excess cash flow to reduce debt and therefore improve the credit – before deciding whether to invest. If Verizon succeeds in reducing debt, the spread could compress to say 80 basis points, which would result in a better return than on typical BBB-rated credits, making it a better value. Yet, value, like beauty, is often in the eye of the beholder.

Other investors might worry that competition in telecommunications services sector could squeeze margins, causing Verizon’s credit quality to deteriorate (and the spread on the 5.15s to widen). If so, the 5.15s could underperform similarly-rated bonds.

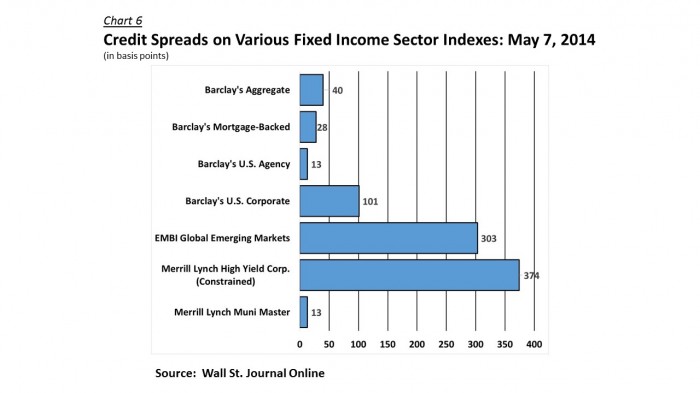

Similarly, yield spreads can be compared across fixed income sectors to decide, for example, whether high yield U.S. corporate bonds offer greater value than high yield municipal bonds.

As of May 7, 2014, yield spreads for key fixed income sectors are given in the chart below:

KEY TERMS:

Yield Spread: a bond’s excess yield, measured in basis points, over the comparable maturity Treasury security. This excess yield represents compensation to the investor for assuming certain risks, including the possibility of default, sub par trading liquidity and higher than anticipated inflation.

Back to Index

Back to Real Interest Rates and Yields on TIPS

Next Topic: Credit Analysis: The Key to Protecting Principal

________________________________________________________________________________________________

Updated May 8, 2014

Stephen P. Percoco

Lark Research

16 W. Elizabeth Avenue, Suite 4

Linden, New Jersey 07036

(908) 975-0250

admin@larkresearch.com

© 2014 Lark Research, Inc. All Rights Reserved. Information is carefully compiled but not guaranteed to be free from error. Specific reference to any specific security should never be construed as a solicitation to either buy or sell. Reproduction without permission from the publisher is prohibited.